1st Formations

Limited Company Accounts

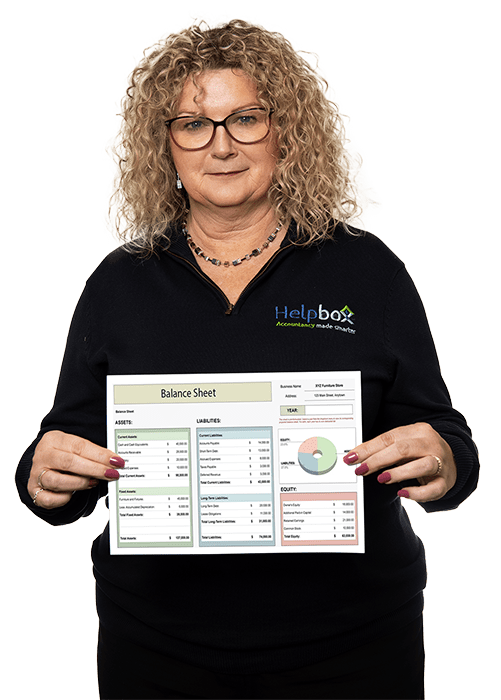

Helpbox is an independently owned, family-run accountancy practice with over 15

years of industry experience. We’re here to offer that trusted, local feel—no matter

where you’re based—by combining smart technology with a people-first approach

years of industry experience. We’re here to offer that trusted, local feel—no matter

where you’re based—by combining smart technology with a people-first approach

Unlimited support, including video calls

Access to FreeAgent bookkeeping software

Monthly payroll for up to 2 employees, including payslips and RTI submissions

Preparation and submission of annual accounts and self-assessment tax returns

Use of our registered office address

Mortgage & rental references

Limited Company Accounts

Limited Company Accounts (Non-VAT Registered) Package – £79.99 + VAT per month

Limited Company Accounts (VAT Registered) Package – £99.99 + VAT per month

Limited Company Accounts (VAT Registered) Package – £99.99 + VAT per month

Streamline Compliance with Expert Limited Company Accounts

Expertise of qualified accountants, personalised advice, and detailed financial analysis.

What’s included?