Penalty Point System – VAT (Update 01/01/2023)

Penalty Point System – VAT (Update 01/01/2023)

Introduction

- The new penalty system is a point-based system (like when you’re driving)

- Each time your VAT return is filed late, you will receive a penalty point

- Penalties will be charged at different rates based on when the data is received

- This change was implemented from 1st January 2023

Late submission penalties

- There will be a fixed penalty of £200.00 once a penalty threshold is reached

- The thresholds are as follows:

- Annual Returns – 2 points

- Quarterly Returns – 4 points

- Monthly Returns – 5 points

- An additional £200.00 penalty will be added every time you are late to file your return after the threshold is reached

How/when points are removed

- Points can be removed once 2 conditions are met:

- A period of compliance – you will need to reach a length of time where you have completely complied with the submission rules, this time depends on how often the returns are submitted:

Annual Returns – 24 months

Quarterly Returns – 12 months

Monthly Returns – 6 months

- All VAT returns due in the last 24 months have been received from HMRC

- Once these 2 conditions are met, the points will be removed, and you will be back at 0

- Points will also automatically expire after 24 months

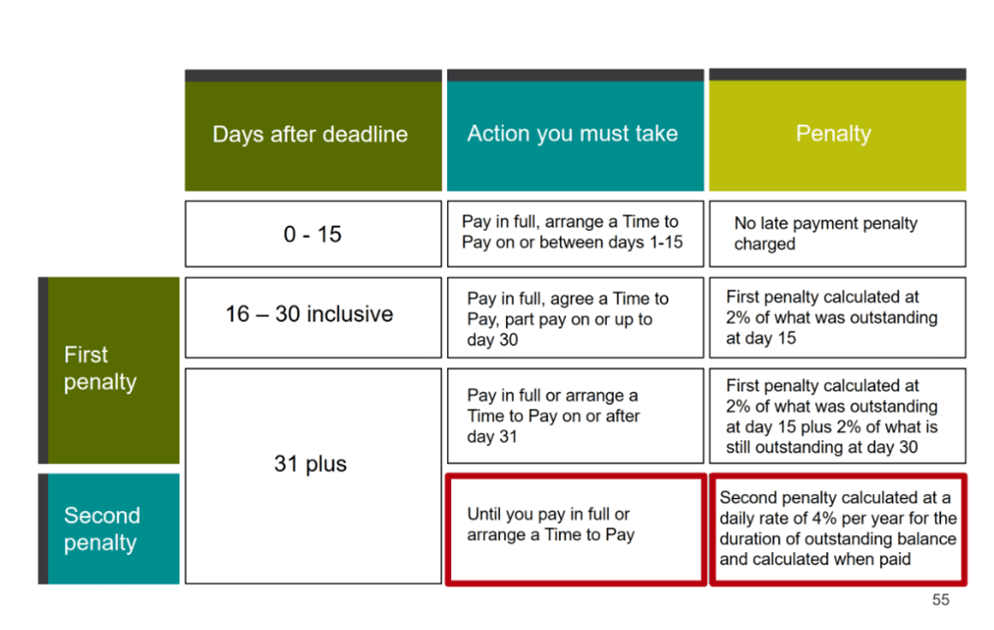

Late payment penalties

- Late payment penalties will depend on when the payment is made. Please see below:

- The penalty for the boxes highlighted in red is calculated as follows:

- The penalty amount on day 31/365 days (1 year) x the amount days till the payment is made from the 31st day

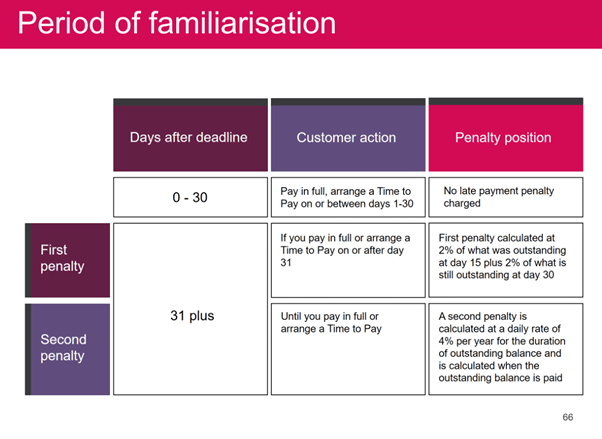

Period of familiarisation

- There is a period of familiarisation which started 1st January 2023 and will end on the 31st of December 2023. See below:

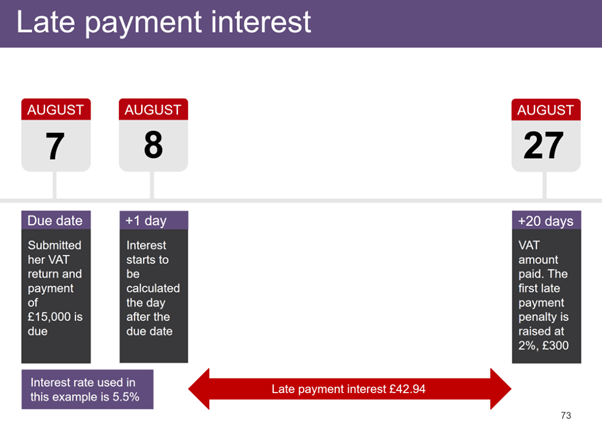

Late Payment Interest

- A late payment interest will be applied

- This will be calculated at a rate of 2.5% plus the Bank of England base rate

- It will be charged from the day the payment is overdue (8th) until the day it’s paid in full

- Late payment interest would also apply to late submission and late payment penalties if they are paid after 30 days

- See an example below:

- The late payment interest is calculated as follows:

- The amount due to HMRC / 100 x the interest rate. That amount is then /365 days (1 year) x the amount days of till the payment is made from the 8th

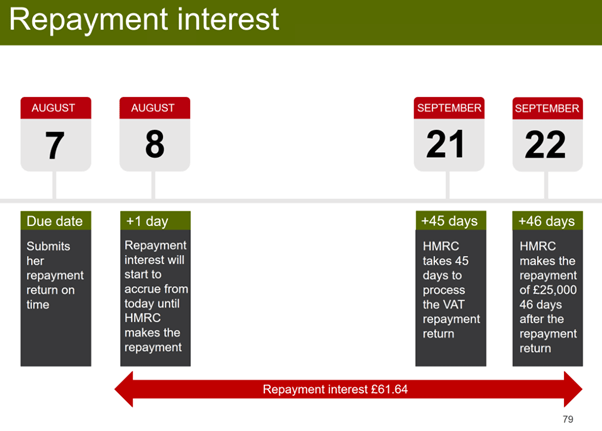

Repayment Interest

- A late repayment interest will be applied to HMRC that will be owed to you

- This will be calculated at the Bank of England base rate minus 1%, with a minimum rate of 0.5%

- It will be calculated from the day after the due date or the date of submission (whichever is later) until the date a repayment is issued

- See an example below: